According to our survey results, rehab facilities are expanding their equipment offerings as they can, betting on increased revenue and more patients in 2022.

By Melanie Hamilton-Basich

People don’t stop needing rehabilitation services just because a global pandemic continues to rage on. In fact, media reports show that strokes and preventable amputations increased over the past year. But some prospective clients have been reluctant to venture out even for important medical care. This, coupled with overall uncertainty related to COVID-19, has caused multiple problems for businesses that affected purchasing.

To better understand the current state of rehab facilities’ bottom lines and hopes for the future, Rehab Management recently conducted a survey about facility-based equipment (valued at $500 or more).

According to the results, rehab facilities are expanding their equipment offerings as they can, betting on increased revenue and more patients as everyone struggles to adjust to a newer normal while the economy and the world attempt to open up. Multiple survey respondents said they decided what to buy in 2022 based on 2021 usage. But many said they are willing to spend more on the products that are needed by patients, when they can find them.

The data collected reveals how much facilities are spending, the types of capital equipment on which they’re focusing their purchasing power, as well as what items respondents hope to purchase in the near future as business picks up.

Popular Purchases

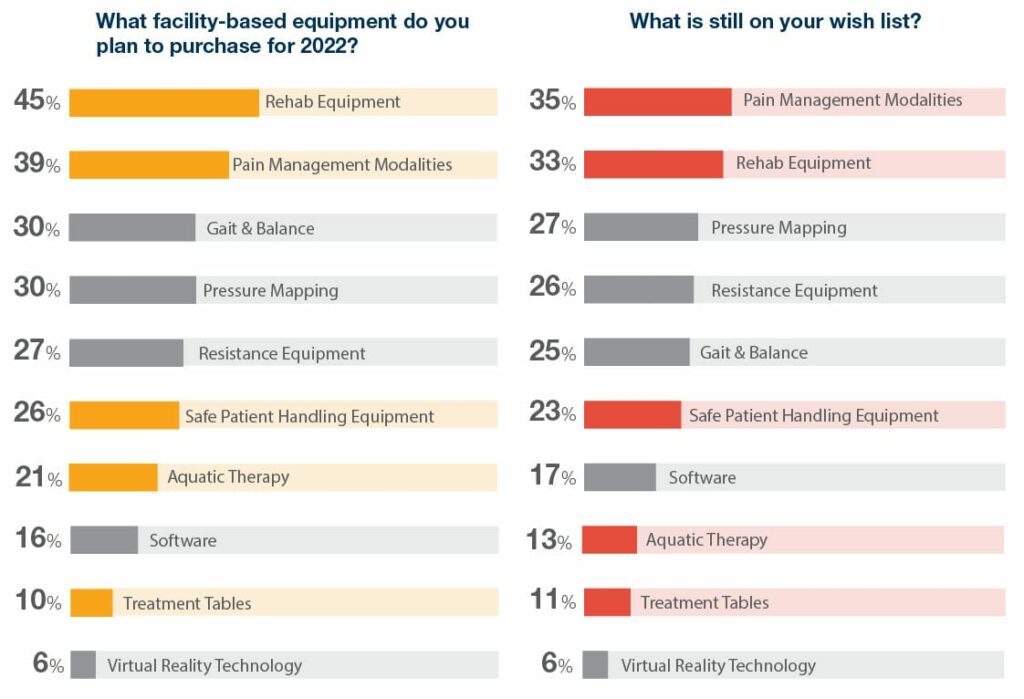

So, what are rehab professionals purchasing for their facilities? Almost half of respondents (45%) planned to purchase rehab equipment, followed closely by pain management modalities at 39%. Equipment falling under the categories of gait and balance and pressure mapping tied at 30%. It’s no wonder that these are such popular purchases for 2022, as respondents reported that three of these same types of equipment traditionally provide the most reliable return on investment, at 45% for pain modalities, 39% for pain management modalities, and 30% for gait and balance.

Other popular items purchased for 2022 included resistance equipment (27%), safe patient handling equipment (26%), and aquatic therapy (21%). Many respondents also reported purchasing software (16%), treatment tables (10%), and virtual reality technology (6%).

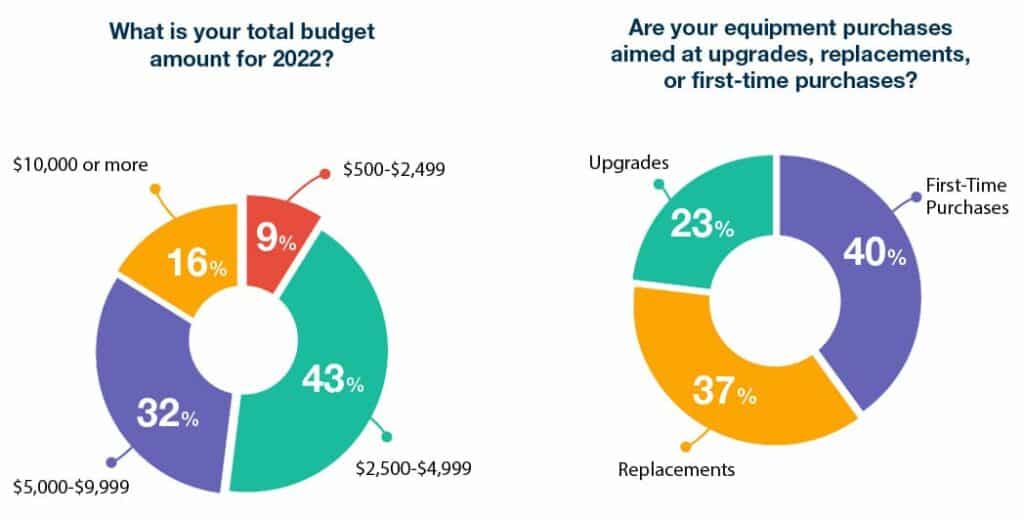

Of the rehab professionals who responded to this survey, almost half (43%) are working with a total annual budget in the range of $2,500 to $4,999, while 32% are able to spend more with a larger budget of $5,000 to $9,999. Only 9% had budgets of less than $2,500, and only 16% had budgets of $10,000 or more.

The COVID Effect

Almost 2 years later, the COVID-19 pandemic is still affecting purchasing decisions for roughly half of respondents’ rehab facilities. In fact, the percentage of those affected has only slightly dipped from 56% to 53% since 2021, according to responses.

The biggest factor voiced by respondents was a lack of funds or smaller budget. One respondent more specifically cited “interruption with in-person services and treatments impacting overall business revenue.”

With continued concerns over the spread of COVID-19, respondents reported that their facilities were suffering from both not enough staff and fewer patients. One respondent said the “lack of staff available [was] impeding skilled admissions.” Another opined the effects of “People problems, machine problems, and price problems.”

Looking to the Future

Still, it’s heartening that 40% of respondents are focused on first-time purchases. This suggests that a large number of facilities are confident enough in their business to see value in spending money on expanding their offerings, also suggesting they might expect to be expanding their clientele. This could also point to an increase in staff that will be able to make use of this new equipment. One optimistic respondent advised, “Try something new and you’ll find unexpected results,” while another said, “Don’t be afraid to buy whatever you want.”

In addition, almost a quarter of respondents (23%) indicated they were focusing purchases on upgrades, a sign that they, too, are optimistic about their businesses’ future. “Don’t be afraid to do what is impossible,” shared one survey respondent.

On the flipside, a full 37% of respondents focused 2022 purchasing on replacements for already existing equipment. This indicates many who took the survey are waiting it out before investing in big-ticket items that aren’t needed right now, like one who commented, “We’ll see how the economy recovers in 2022.”

Looking to the future, multiple rehab professionals shared advice for how to approach purchasing facility-based equipment that included, “Listen to employees’ suggestions and customers’ needs,” and “Take the long view.” Others shared that their more pressing concerns are being able to buy in bulk again, having the funds to buy more products they need, as well as continued disinfection safety. RM